21 School of Economics staff at Bristol give their views on recent economics hot-topics. Where does the expert consensus lie?

21 School of Economics staff at Bristol give their views on recent economics hot-topics. Where does the expert consensus lie?

By Ethan Lester

Just as we are entering a new academic year here in Bristol, we are witnessing some major economic developments unfold – both at home and abroad. Firstly, a recently embattled property developer in China is now on the brink of default. Snowed under its crushing debt of $300bn, Evergrande is so huge that the fallout from any failure could hurt not just China’s economy, but could promise a repeat of the 2008 Global Financial Crisis. Meanwhile, in the UK, a food, fuel, and labour crisis could cause a ‘winter of discontent’, with hardship on a scale not witnessed since the 1970s. Also in the UK, the recent termination of the government’s Furlough scheme has propelled over 1 million employees into a state of limbo.

Such developments naturally generate a lot of questions. In this blog series, three questions are chosen on a monthly basis to ask the staff in Bristol University’s School of Economics. Just like the IGM panel of world-leading economists, our staff panellists express their opinions on a scale that slides from ‘strongly disagree’ through to ‘strongly agree’, with ‘neutral’ in the middle. This blog will compare and contrast staff opinions, and then give a final verdict on what the experts really have to say about some of today’s most pressing economics issues.

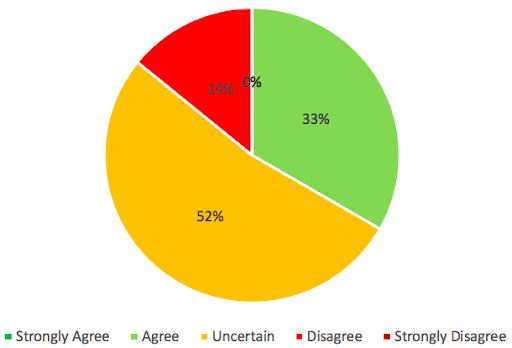

Question 1: ‘The Chinese property developer Evergrande has warned that it is at risk of defaulting on $300bn of debt. Do you agree that there is a risk of another major financial crisis?’

Any comment on this question?

Anonymous: I agree. Although, the interlinks with other financial institutions may be weaker than with the Lehmann case.

Anonymous: I’m uncertain. Chinese policy choices will be crucial to decide on this, and I am not an expert in Chinese politics.

Sarah Smith: I’m uncertain. A big issue is whether it is just Evergrande, or whether this is just the tip of the iceberg.

Leandro De Magalhaes: I disagree. China has the funds to bail out major companies like Evergrande. Future growth prospects for China are majorly diminished as its GDP growth was too dependent on real estate (similar to Spain prior to the financial crisis).

Verdict: Just over half of the economists in this survey were unsure as to whether or not the Evergrande situation shares parallels with the 2008 financial crisis. A third of the experts agreed with the statement, whereas 14% disagreed. Meanwhile, none of the experts were willing to say that they strongly agreed or disagreed. So, opinions mostly came from the middle ground. This might be because the economists do not have specialist knowledge on the Chinese economy, or simply because there is just so much uncertainty around the question. One economist implies that if more companies like Evergrande reveal that they have a large-scale debt problem, then another financial crisis is a possibility. In which case, we should be concerned: Shimao and Sinic are among the many other firms in China’s property sector at risk of loan defaults. Another economist believes that systemic risk in the property market might not pose the same threat as in financial markets, due to lower levels of interconnectivity between firms. Alternatively, one expert argues that the Evergrande case is not a cause for concern because China can afford to pay for expensive bail-outs. Ultimately, no two economists gave the same explanation for their opinion.

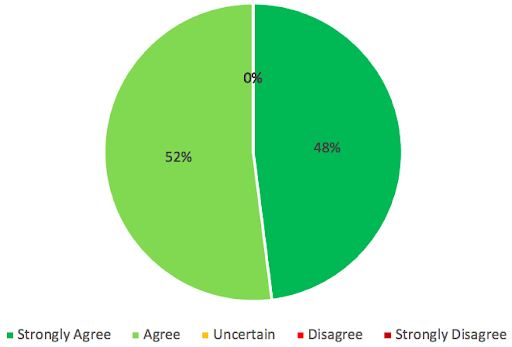

Question 2: ‘Do you agree with the Director of Food and Sustainability at the British Retail Consortium that the UK visa schemes are ‘not enough’ to ease lorry driver shortages?’

Any comment on this question?

Anonymous: I strongly agree. A country that offers no future to migrants as its main policy cannot attract migrants. Who would have guessed that migrants are people who want to be treated correctly?

Peter Spittal: I agree. I think a few things happened — including migrants leaving the UK, and reducing their mobility, due to covid. But the limited number of visas is also likely to have been an important factor.

Anonymous: I agree. Shortages are because of other issues too, such as the huge disruption to the economy due to Covid… how many people today are thinking about switching jobs? Do you think it is a good idea to be a lorry driver today when self-driving cars/trucks are a reality?

Verdict: To the statement that UK visa schemes will not solve shortages of lorry drivers, there was unanimous (100%) agreement among the surveyed economists. It is not often on this blog series that the experts reach such a clear consensus. This might tell us that the government is ignoring expert advice when it has been managing the driver shortage crisis. Perhaps due to ‘hostile environment’ policies and rhetoric, visa schemes will not be enough to attract lorry drivers. Perhaps also, the pandemic has reduced labour mobility so much that a visa scheme merely resembles a sticking plaster over a much deeper wound. Or maybe, the visa scheme is not enough because technological change threatens the longer-term viability of lorry driving as a vocation.

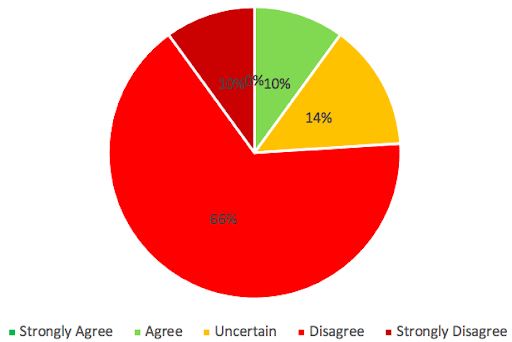

Question 3: ‘The UK’s Furlough Scheme ended this Thursday. Do you agree that this was too soon?’

Any comment on this question?

Anonymous: I’m uncertain. The end of the furlough scheme is not the main issue; the issue is about other redistributive schemes which are non-existent.

Peter Spittal: I strongly disagree. There was no indication of a spike of planned redundancies when the scheme ended, meaning few still-furloughed jobs seemed to be at risk. More generally, the furlough scheme was designed to support workers temporarily unable to work because of coronavirus restrictions, and these have now been lifted. Additional help for workers searching for a new job – possibly in a different sector – seems the best policy now, probably coupled with increased unemployment insurance as a part of Universal Credit.

Anonymous: I’m uncertain. More than the time it ends, the problem is that we do not know much about behaviour once it is over.

Leandro de Magalhaes: I disagree. The timing looks ok as most restrictions are ending. The mistake was to end the Furlough scheme at the same time Universal credit decreased.

Verdict: Two out of every three economists in this survey disagreed that the UK’s Furlough scheme ended too soon. A further 10% strongly disagreed. Perhaps Furlough is no longer necessary given the lifting of lockdown restrictions. Rather than Furlough, a boost to Universal Credit, greater unemployment insurance, and other redistributive schemes could encourage levels of employment to recover to pre-pandemic levels. One economist feels uncertain about the behavioural implications of Furlough’s ending, due to the novelty of the pandemic. Overall though, the consensus was that Furlough did not in fact end too soon.

Final thoughts

This survey aimed to find the expert consensus on three topical economic questions. On whether or not the crisis at Evergrande is likely to cause a global economic crash, the experts were reluctant to take a strong stance. On the effectiveness of new visa schemes to tackle the lorry driver shortage in the UK, all of the economists agreed that policies need to be more ambitious. For the third question, most of the economists agreed that Furlough ended at the right time.

Why was there a weaker consensus for the Evergrande question when compared to the questions about visa schemes and Furlough? Is it because Bristol’s economists know more about the UK than about China? Or are our economists just more passionate about questions related to the labour market than ones about the property market? Or maybe, is it because there is less empirical evidence and economic theory available to answer the first question when compared to the others? Clearly, there are many factors that determine if economists will give the same answer to a given topical question.

What would you like to Ask the Experts? Send an email to Ethan with your suggestions for future questions on this blog.

Discover research from the School of Economics on our website.