Staff at the University of Bristol’s School of Economics grapple with COVID-19 related economic questions. Where does the expert consensus lie? Find out in the third blog of the ‘ask the expert’ series from undergraduate student, Ethan Lester.

Staff at the University of Bristol’s School of Economics grapple with COVID-19 related economic questions. Where does the expert consensus lie? Find out in the third blog of the ‘ask the expert’ series from undergraduate student, Ethan Lester.

As the public health crisis unfolds, so too does the economic crisis. Can the experts agree on how to solve it? Recent evidence would generally answer in the affirmative: economists can and do agree with each other on key issues. Indeed, among the IGM panel of leading academic economists from the world’s top universities, only 8% of experts are expected to go against the grain on topical economic questions, and for nearly a third of these questions, there are no dissenting voices at all. (Source, Discover Economics.)

In the spirit of the IGM panel, this series on the Economics Blog aims to locate the consensus among Bristol University staff on some of the main economic questions raised by COVID-19. As was explained in the series introduction, the format entails three questions to be answered on a scale of agreement (a ‘Likert scale’), with the option to add a comment.

We are grateful for the volume of responses from department staff, but in the interests of brevity, we have only included a handful of them per question in this article.

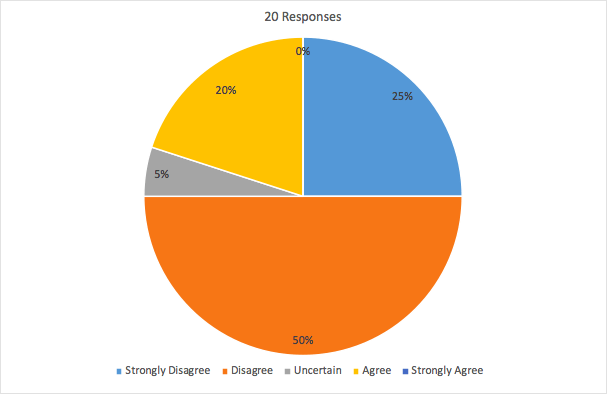

Question 1: Economists at Deutsche Bank have proposed a 5% tax for each day workers work from home, to fund subsidies for lower-paid workers who are not able to carry out their jobs from home. Do you agree that this is a good idea?

Any comment on this question?

Jahir Islam: I agree. Everyone needs to contribute to face this challenge, otherwise recovery will be slower and in the long run, it will be costly for everyone.

Hakki Yazici: I agree. There is evidence that the economic impact of the pandemic hit low-income workers the most. This may be a good way of redistributing toward them.

Patrick Arni: I disagree. Additionally taxing labour in times of rising unemployment is a bad idea. Since work from home is an important part of the future of labour, additionally charging this behaviour sets an awkward incentive and signal. Tax raises to fund Covid support expenses will hardly be avoidable at some point, and none of the solutions will be perfect and non-distorting. But for instance, a temporary increase in taxes on different types of capital gain (also on real estate gain, e.g.) would affect smaller parts of the economy and act to some degree against increasing inequality.

Hans Sievertsen: I disagree. The main idea should be to redistribute from those hurt less (or not at all) by the pandemic to those hurt a lot, but I don’t think that encouraging people to go to the office by adding a tax on working from home is the best thing to do during a pandemic. Some countries subsidize commuting (like Denmark), which kind of leads to the same, with the argument to support agglomeration effects and increase job mobility, but encouraging travel might not be ideal from an environmental perspective.

Edmund Cannon: I strongly disagree. This would provide an incentive to commute to work. Commuting is environmentally wasteful. Presumably, Deutsche Bank’s next suggestion will be to cut down more virgin rainforest. The primary way to raise revenue should be to close down tax avoidance by the wealthy.

Pawel Doligalski: I strongly disagree. Taxing working from home and subsidising jobs that are not suitable for working from home is a really bad idea in a time when working from home is crucial for containing the pandemic. Such a tax and subsidy would give incentives to avoid working from home for workers and to avoid investing in home-working friendly environments by firms, which is exactly the opposite of what we should be doing right now. If we want to support workers who cannot work from home and face additional health hazards, let’s provide them with equipment to minimise this health hazard, and fund it either by debt or by taxes which are not as distortionary as the one suggested.

Verdict: Precisely half of the respondents take issue with Deutsche Bank’s proposal. These economists note the negative externalities that come from commuting during a pandemic (a few going further with comments on negative externalities from commuting in general). Some of the nay-sayers believe taxes should be raised on corporations or on capital gains instead of labour; others offer a complete reversal of Deutsche Bank’s position to advocate incentives for working at home. The minority who agreed are persuaded by the redistributive potential of the tax or are convinced tax hikes are inevitable given the ballooning budget deficit – although, there were zero yay-sayers with strongly held convictions. Nevertheless, we can infer that the proposal is at least quite divisive because only one economist was unsure of how they felt about it.

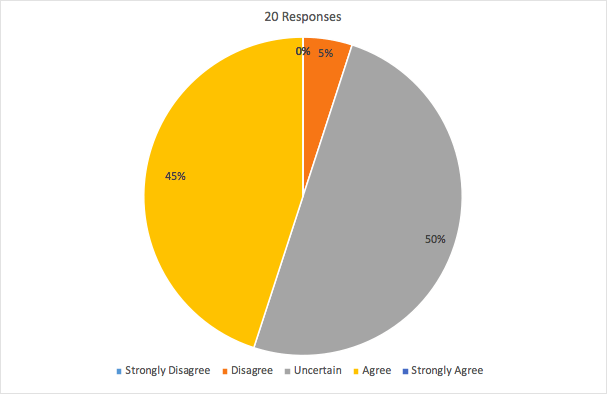

Question 2: Economic damage from the virus and lockdowns will ultimately fall disproportionately hard on low and middle-income countries.

Any comment on this question?

Hakki Yazici: I agree. In part, because they are going to receive the vaccine much later.

Toman Barsbai: I’m uncertain. Hard to generalise. There is/will be lots of variation here. When it comes to the virus, the age distribution is more favorable (younger) in low- and middle-income countries. To the extent that low- and middle-income countries make less use of hard lockdowns, I expect them to be less affected.

Árpád Ábrahám: I’m uncertain. These countries may choose very different lockdown policies as they may see the trade-off between saving lives and saving the economy differently.

Leandro De Magalhaes: I’m uncertain. Low-income countries have a different age profile, thus implying the economy may be less affected. Also low and middle-income countries have larger informal sectors that may ignore any lockdown measures.

Pawel Doligalski: I’m uncertain. China is the case of a middle-income country that, paradoxically, turns out to be the least adversely affected. Of course, there are multiple examples of LM-income countries that suffered a lot, e.g. Brazil. It is hard to generalise, perhaps income level is not the key variable to determine the economic burden of COVID-19. I think that in the long term COVID-19 may be a problem for countries with a large part of the population employed in manufacturing, as this prolonged pandemic and lockdown is likely to be a strong push towards automatisation, which may turn these jobs obsolete quickly.

Anonymous: I disagree. No, this is the fallacy of composition: it will mostly affect poor people (we are replacing jobs that involve personal services: I do not need anybody today to go to the supermarket, I buy a lot online, and I do not visit restaurants; I got used to Netflix so bye-bye cinemas, all luxury goods have moved online (bakeries, clothing)). Those countries that have a larger proportion of these workers in the labour force will be most affected by it. But thinking of solutions country by country will not solve the problem of those countries, the solutions must be provided to the individuals: more training and education, and relocation (within the country) to areas where demand is increasing (where is Amazon headquarters and storage units: build houses there.)

Verdict: This question inspired little confidence from our economists: 50% answered without any degree of certainty. This should be of little surprise because the dust might not settle on the Covid crisis for years to come, so we cannot make an accurate comparative analysis between countries until then. Almost all the remaining responses were more assuredly (but not strongly) pessimistic. One economist touches on the potential for inequality from governments charging their citizens for vaccinations; another on the fact that lower-income countries tend to have inadequate social safety nets for those hit hardest by lockdowns. One anomalous disagreement was a technical point on how the effects of Covid shouldn’t be confused with the effects of structural shifts which have increased inequality for at least a decade now.

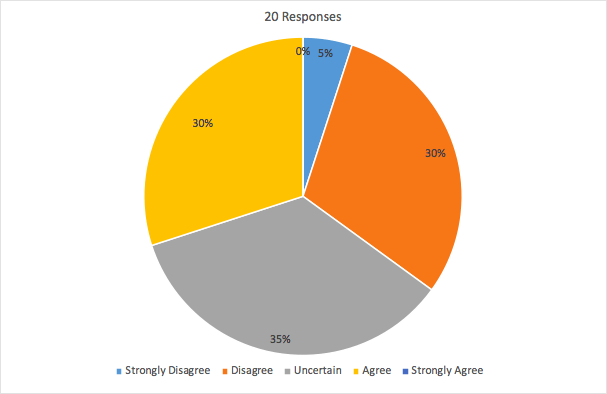

Question 3: Former Sainsbury’s chief executive Justin King said on BBC Radio 4 that ‘a good chunk of the money spent on furlough is just avoiding the inevitable’. Do you agree?

Any comment on this question?

Edmund Cannon: I agree. Environmental and technical change means that lots of industries need to be dramatically reduced in size or even closed down (e.g. aviation transport). In the short run, furlough payments are probably unavoidable. In the medium term we need to spend the money to enable workers to re-skill for new jobs (e.g. “greening” the economy) so that we avoid the disastrous mistakes that the Conservatives followed in the 1980s when obsolete industries were being closed down.

Anonymous: I’m uncertain. Part of the furlough scheme is just a way to subsidise consumption during the crisis, given the very low unemployment insurance in the UK. So, the furlough scheme may not prevent businesses from failing, but it compensates for a dysfunctional benefit system. One issue with the furlough system is fraud, which seems accepted by policymakers when it comes from employers rather than workers.

Leandro De Magalhaes: I’m uncertain. This is a timing problem. If a vaccine brings us back to normal by April, then I would disagree. If the new normal will last for years, then I agree.

Patrick Arni: I disagree. Application of furlough is broader than just on businesses which are in poor condition anyway. So it will avoid some bankruptcies and save some jobs which will be stable in the longer run. Experience from other countries shows such positive longer-run impacts. But nonetheless, there is a “tipping point” where furlough also will support the survival of businesses with poor prospects.

Anonymous: I disagree. The furlough scheme has acted to protect both employees and employers. However, there may be some firms where either demand does not return to pre-pandemic levels, or where financial distress from the loss of months of income leads to insolvency. For these, employment may not continue for long after furlough. However, it may be better to keep individuals in employment now, rather than lock individuals into months of unemployment.

Pawel Doligalski: I strongly disagree. I interpret it as saying that many jobs covered by furlough will be destroyed as soon as the scheme ends. This statement strongly underestimated the uncertainty we face about the future (will the vaccine arrive quickly or not any time soon? will it be effective?). It also misses the fact that the purpose of furlough is to insure firms and workers while giving incentives to preserve productive employment relationships. The insurance value means that even if all of these jobs will disappear in the end, there is a benefit to the scheme.

Verdict: Especially when compared to the first two questions, this question strongly divided opinion. Indeed, there was an almost equal agree-neutral-disagree split; owed mostly to Justin King’s ambiguous use of the word ‘inevitable’. The agreers stress the futility of keeping jobs afloat in dying industries because of the need to restructure. The neutral camp can be summarised with the musings of one respondent: ‘I wish I had Justin King’s crystal ball’. Meanwhile, most disagreers looked to the long-run to defend the decision to extend furlough. The only ‘strongly’ held response came from an economist who conceives of employment insurance as the immediate-term preservation of employer-employee relationships.

Final thoughts

Each of the three questions provided distinct trends. Firstly, there was strong disagreement on a potential ‘work from home’ tax. This question generated some of the most passionate responses seen on the series so far – one economist called it ‘dumb’, and believed the proposer ‘would never pass a basic economics course’. Secondly, there was a lot of uncertainty over how the Covid crisis might differently impact low-and-middle-income countries. If lower-income countries have been worse hit, a multitude of factors could be the cause. Perhaps this question was not specific enough to stimulate strong debate. Thirdly, a statement criticising the extension of furlough proved quite divisive. What was interesting to observe was how different economists made different interpretations of Justin King’s choice of language, and how this interpretation would form the basis of their analysis.