Ask an Economist: Bank of England Monetary Policy Report with Malindi Myers, presented at Bristol Festival of Economics in November, review by undergraduate student Ben Pimley.

Ask an Economist: Bank of England Monetary Policy Report with Malindi Myers, presented at Bristol Festival of Economics in November, review by undergraduate student Ben Pimley.

Malindi Myers, as the South West Agent of the Bank of England, is one of the best-placed experts to talk about the real impact Covid-19 is having on the UK economy. In this session, she set out to explain the Bank’s November Monetary Policy Report. Due to reporting regulations, Malindi was not enabled to indulge us with any quirks in the Bristolian economy caused by the pandemic but she did trace a broad national pattern of downside risks.

In a year of unprecedented economic and social upheaval, the UK central bank’s core message remains unchanged: the best way they believe they can support the economy is through low and stable inflation. This simple statement conceals the arsenal of policy instruments currently being used to achieve the medium-term inflation target: interest rates at a record low 0.1%, quantitative easing on track to reach £875bn by the end of 2021, and forward guidance of no rate increase until there is confidence in the recovery.

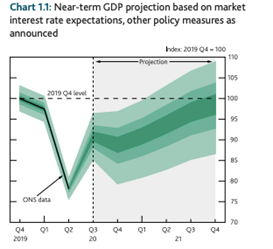

The ‘fan chart’ from her talk, which depicts the probability of various outcomes for GDP, illustrates the scale of the challenge facing Malindi and the Bank. It is a stark visual reminder of the level of uncertainty facing policy-makers in the year ahead as they try to weigh up vaccine news, ‘lockdowns’ restrictions, and Brexit. The difficulty of the latter is accentuated by the fact that the Bank must calculate projections on the basis that the UK will negotiate a comprehensive free trade deal. This is an eyebrow-raising proposition with time running out to finalise a deal.

Lighter colours indicate less likely outcomes. More details about this type of chart can be found on p39 of this report.

Ms Myers also touched on how Covid-19 is reshaping what we buy, what we make, and how we work. The government advert: “Fatima’s next job could be in cyber” provoked amusement on Twitter recently, but the Bank is seriously modelling the long-term scarring effect on the economy and the structural unemployment created by new growth sectors.

This talk was a timely reminder that the technocratic Bank of England stands ready to support the UK economy within its limited mandate but ultimately elected politicians must make the tough fiscal policy decisions as they attempt to navigate a ‘green’ recovery that does not leave citizens behind.